Investors, we have a problem...

A once-in-lifetime market environment over the past 12 years, where both stocks and bonds appreciated at a record-setting pace, has potentially resulted in a once-in-lifetime value-trap for retirees. The following post just begins to outline the headwinds the capital markets will face over the next decade.

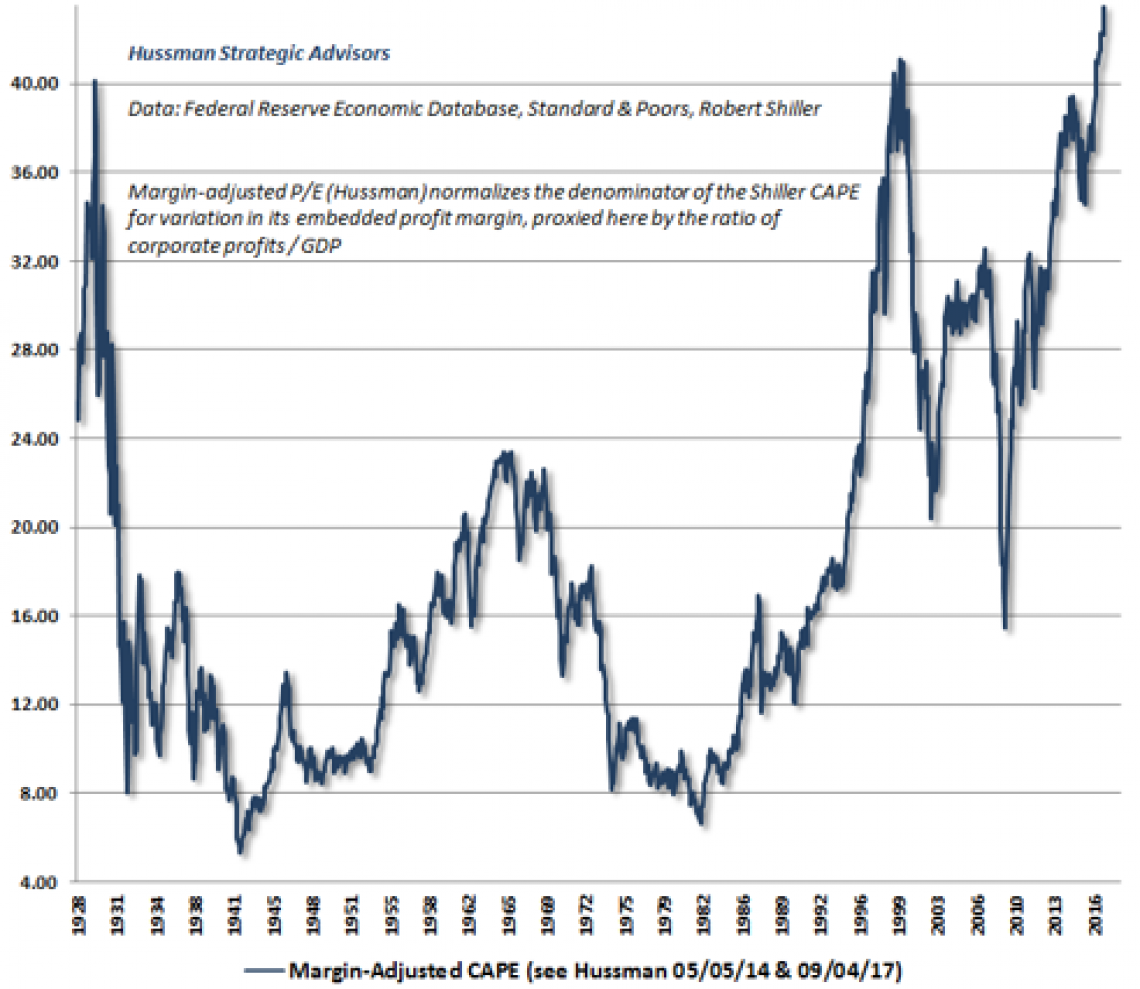

Chart Credit: John Hussman, Ph. D., Hussman Funds

Problem #1: Equity valuations at all-time highs.

Never before has an investor paid so much for earnings as she did by 2021. Historically, there has been a significant, negative correlation between equity valuations and future returns. Translated, all-time high valuations equal all-time lows in future returns.Dr. Hussman has done extensive research on the strong inverse correlation between valuations and future returns. You can read some of his commentary on his firm's website.

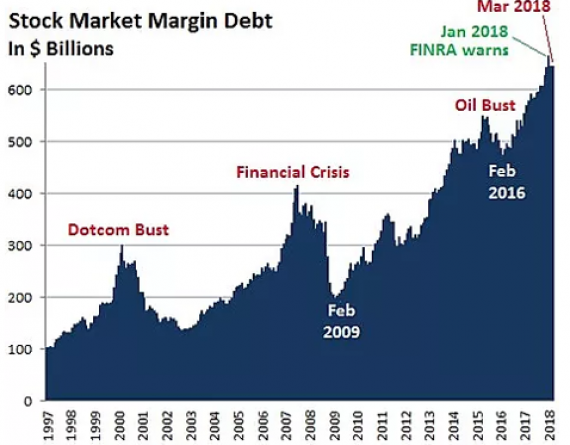

Problem #2: Market leverage at all-time highs

Margin debt, an acute measure of leverage, is at its highest point in history. Higher before the "dot.bomb" bubble burst, higher than the "Goldilocks/Housing" bubble burst, and even higher than in 1929 and 1987.

Truly, nothing really bad happens in the stock market until leverage gets out of hand. In March of 2020, market participants received a small taste of what could come if we have another liquidity event. Of course, the FED was able to pump the bubble back up but another exogenous event could prick it all over again.

Problem #3: Interest Rates at all-time lows

Artificially low interest rates punish the retiree in two ways. First, she cannot obtain a decent yield on her retirement assets thus forcing her into more risky investments. Second, bonds will not be able to provide the diversification or safe harbor play they have historically in a bear market. Yes, rates can go below zero but most economists say it is not sustainable. Eventually, bond yields must rise and in turn cause bond positions to lose value. If this takes place while equity markets decline, it will likely lead to dire consequences in a traditional allocation of stocks and bonds.

The Solution for the Value-trap Perfect Storm

All three of these factors combined may create a perfect storm for retirees, especially those who need an income from their retirement assets. We have developed a sophisticated strategy for dealing with future market volatility using a proprietary trading system that limits losses on all our client positions while consistently locking in gains in profitable positions. Our program is entirely unique allowing us to participate when the market is appreciating yet moving to cash or non-correlated securities when stock markets are declining.

You can click on the links below to learn more about how we do what we do. Or feel free to call us if you would like to discuss how we may help you. You can reach out to us via our Contact Us page or call us at 214 | 943 4300. We would appreciate the opportunity to visit with you.