Heads I Win, Tails They Lose

Athene Index Annuities (IA) are often positioned as a "Can't Lose" proposition. Unfortunately, too often they become a "No-Win" situation. Decades of exposure to annuities attests that there are 6 Critical Faults that will compromise an investor's financial future when utilizing Athene's lineup of index annuities.

- IAs provide a small fraction of the index's returns effectively converting your current dollars to future cents.

- Despite an enticing teaser rate from the "Guaranteed Lifetime Withdrawal Benefit" rider (GLWB), the more critical distribution rate is garbage.

- IAs are a tax

shelterbomb. - IAs can greatly reduce the legacy left to the heirs.

- Policyholders get paid last, thus reducing the incentive to perform.

- Guarantees may become worthless under specific market conditions.

While exhaustive, this list is far from conclusive. Of the multitude of ways an IA can fail, these are the most costly. IAs are often sold in such a way as to disguise the true nature of the product. Our objective is to help you see beyond the deception so you can then make a truly educated decision for yourself, your family, and your money.

There are three easy steps to implementing the same investment objective as a Athene IA but with far better results, which will be covered below. As Dave Ramsey says, "Stop making everyone else rich." You can accomplish the Index Crediting Method (ICM) utilized by a Athene annuity all on your own or, if you prefer, with a little help from us.

Fault #1: Converting Current Dollars to Future Cents

What they say...

Participate in the upside potential of the stock market while fully protecting your principal from market risk. Heads you win, tails they lose!

What they don't say...

The Index Crediting Method (ICM) utilized by IAs does not receive credit for dividends while upside performance is capped. Historically, these limitations have led to catastrophic underperformance.

The Nitty Gritty and the Down and Dirty:

The operative word is "participates." An IA doesn't track, mimic, shadow, or "bird-dog" the index, rather its Index Crediting Method merely participates. Historically, that participation rate has been abysmal.

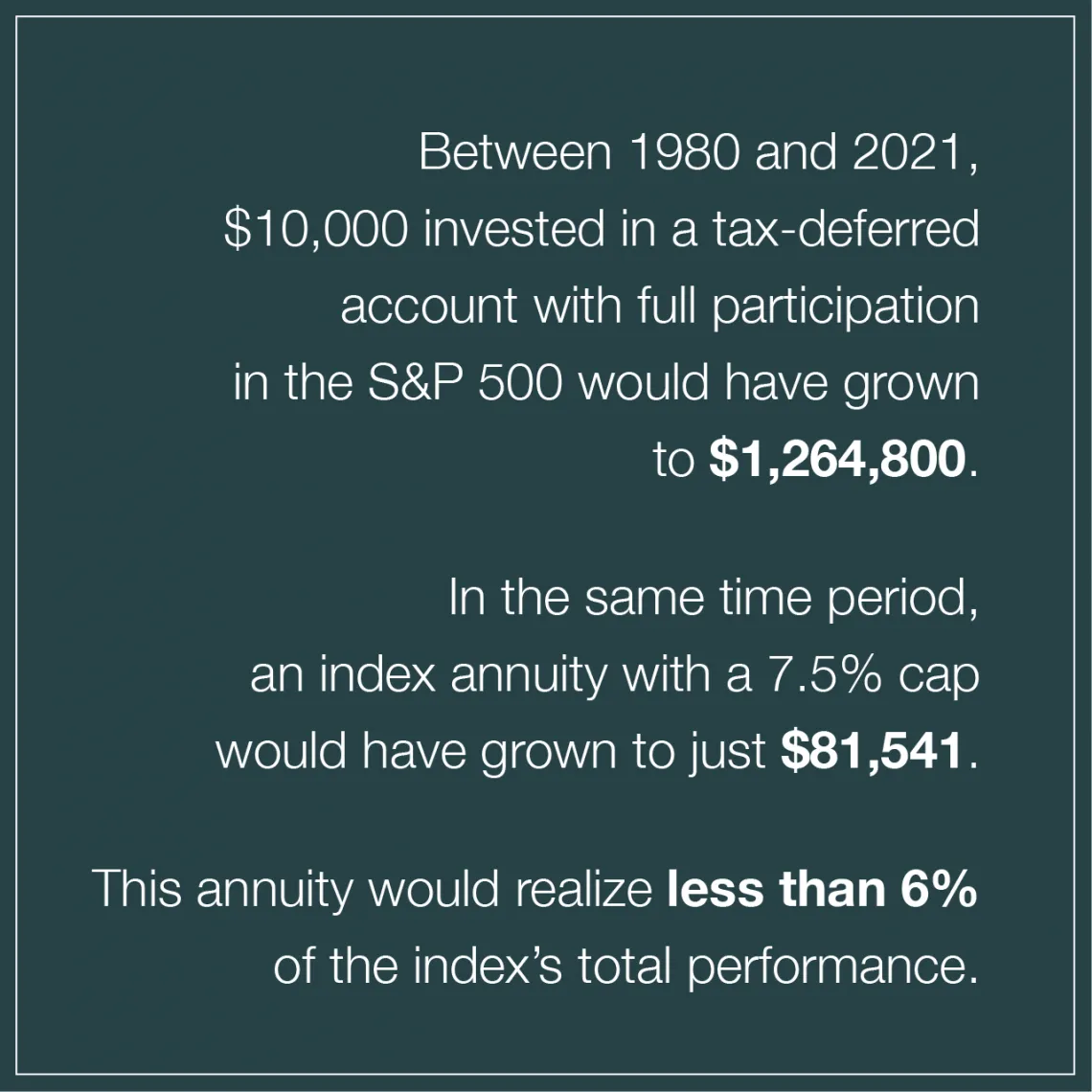

An IA does not receive dividend income from the index, and since 1980, reinvested dividends have accounted for half the return of the S&P 500. Further, Athene's most popular product currently only participates in 60% of the S&P 500's growth - and that figure can go decrease to 10%. 10% of the growth, no dividends, no interest. These issues guarantee the contract will underperform by an incredible margin.

The "financial professional" will claim the insurance company has a "proprietary model utilizing complex, sophisticated investment strategies" to deliver this enticing guarantee. In truth, the investment strategy they use is actually fairly straightforward and easy enough to do in your own account...and with far better results.

The Bottom Line

Didn't your mother tell you, "When something sounds too good to be true, it probably is?" Insurance companies do not have access to some sort of magical investment machine that generates excess risk-free returns. They utilize the same markets you and I do. Insurance companies are not charities, they are for-profit enterprises, who are far more concerned with their own bottom line than yours. In the case of Athene, since 1980, their most generous IA contract failed to capture 88% of the S&P's total returns.

Compare Their Model to the S&P 500

Get a free report comparing the historical performance of the S&P 500 versus Athene's IA offerings.

Fault #2: Distribution rates are garbage

What they say...

25% first year bonus! 10% annualized growth each year there after!! Generate an income you cannot outlive!!!

What they don't say...

Yes, the initial teaser rate is enticing and yes, it provides an income you cannot outlive. But the distribution rate is garbage resulting in an income you cannot live on.

The Nitty Gritty and the Down and Dirty:

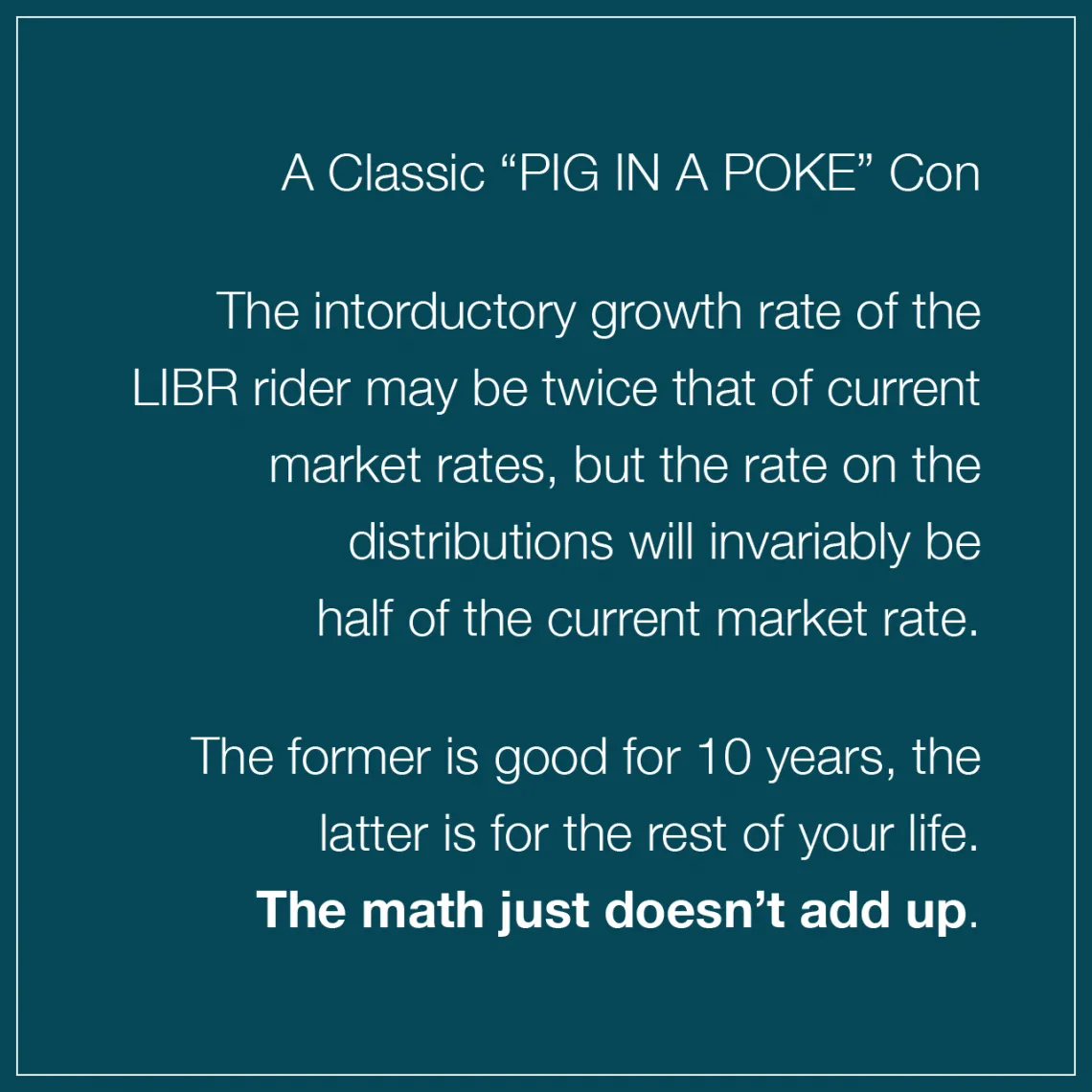

The "GUARANTEED RETURN RATES" promised by Athene's IAs are a component of a separate policy rider called the "Guaranteed Lifetime Income Withdrawal Benefit" (GLWB). The intricacies of the GLWB are complex. It would take days to fully explain how "THE CON" works. For the sake of brevity, I can tell you that in the 20 years since the GLWB concept was developed, I have yet to see one with an effective rate of return in excess of 2%, well below the current risk-free rate of US Treasuries.

The fantastic growth rate of the GLWB rider is only available if the policyholder exercises the GLWB's "lifetime income benefit". The benefit base of the rider does not represent "money in your pocket" nor is it available for a lump-sum payout. That 25% is just a fictional number used to calculate a benefit base. Unfortunately, the distribution percentage of the benefit base is garbage.

Currently, the distribution rate for Athene's GLWB is about half of what the open market would deliver. Thus, the contract grows at a rate that is 50% above the current risk-free rate but then only pays out 50% of the market rate.

The Bottom Line

While the initial teaser rate is above market, the distribution rate, which is far more critical, is well below market. In addition, the contract is subject to significant interest rate risk as Athene will surely never increase the distribution rate.

Possibly, the most dire aspect of the GLWB is the fact that if it outperforms the Index Crediting Method, the annuity becomes a lifelong commitment as the only way to achieve the GLWB is to opt into the lifetime income.

Compare Their GLWB benefit to Risk-free US Treasuries

Get a free report comparing the hypothetical performance of Athene's products versus a combination of US Treasuries and an immediate annuity.

Fault #3: An Index Annuity is a tax shelter bomb

What they say...

Index Annuities enjoy tax-deferred growth!

What they don't say...

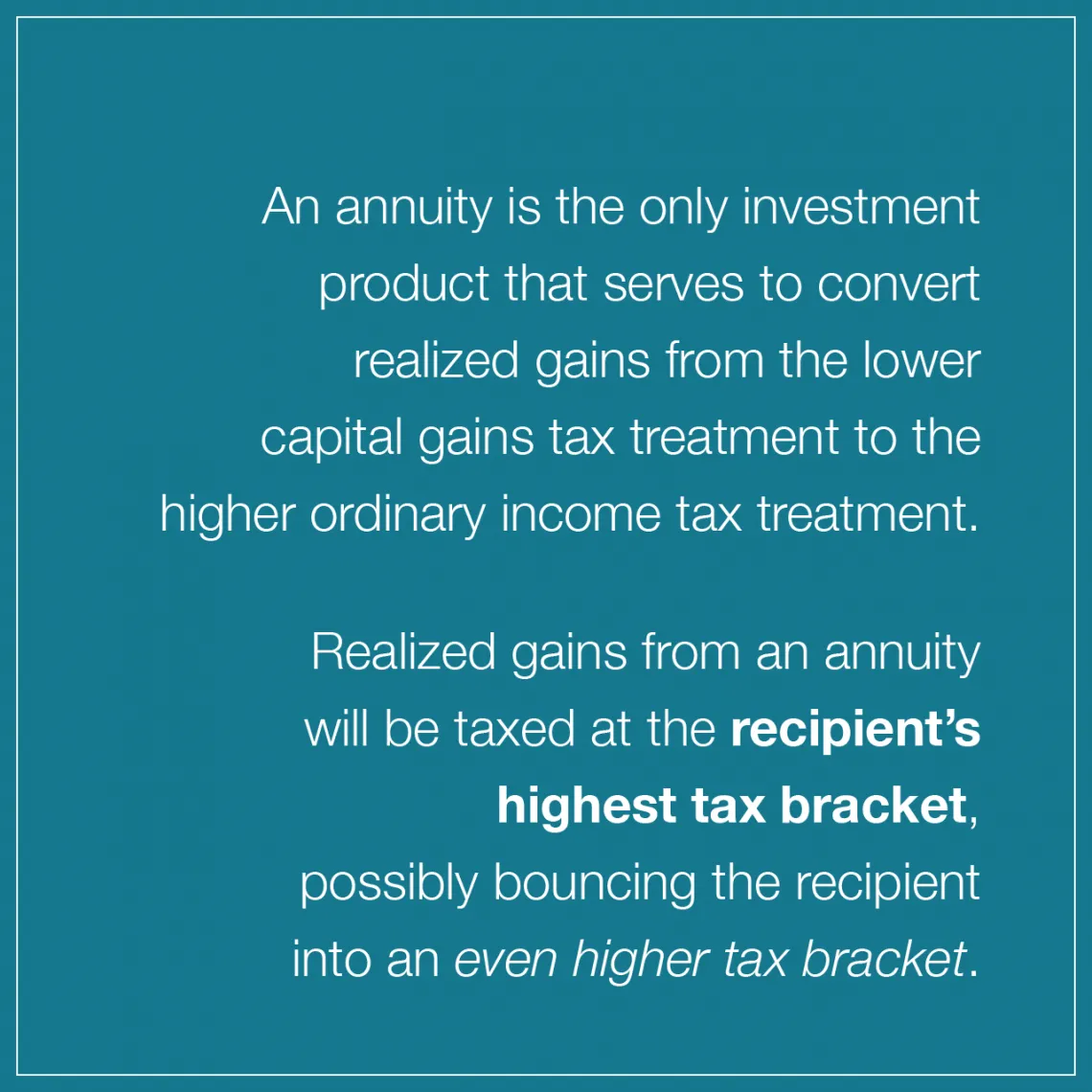

Practically any investment in an equity index virtually grows tax-deferred on its own, without a restrictive annuity contract. Further, realized gains in an annuity would be taxed at a much higher rate than an index-based mutual fund or individual stock holdings.

The Nitty Gritty and the Down and Dirty:

The S&P 500 is a market-cap-weighted index comprised of 500 stocks. Market-cap-weighted means the largest companies account for more of the index's performance than smaller companies. Currently, the index's five largest companies, AAPL, MSFT, AMZN, NVDA, and TSLA, comprise 22.44% of the index. While these stocks only comprise 1% of the companies in the index, they are responsible for nearly a quarter of the index's performance.

In any given year, the S&P 500 may replace 4 or 5 stocks, thus, selling only 1% of its holdings. And taxes would only be due on realized gains resulting from the sale of these 4 or 5 securities. These 4 or 5 companies will invariably be the smallest weighted stocks in the index making up a minuscule percentage of the overall index. This year, the 5 smallest stocks compromise just 1/10 of 1% (0.10%) of the index. Thus, if the S&P elects to remove these five stocks, 99.9% of the index's growth should be tax-deferred while 0.1% should be taxable. The point is that it's hardly necessary to buy an index inside of an annuity to achieve effective tax deferral.

The Bottom Line

Of all the claims made by Athene, the tax-deferred status of the contract has to be the most asinine. There is not a single scenario that supports an index-based annuity being more tax-efficient than buying an index through a mutual fund or by utilizing individual stocks.

Robert Kiyosaki says there are three types of fools: crooks, clowns, and cowards. When an annuity salesperson promotes the tax-deferred benefits of an IA, he is proving to be all three.

Obtain a FREE REPORT detailing the Specific Faults of Athene's Offerings

Tap into our extensive database to learn all the critical points of failure of the "Fore" Annuity Product Lineup.

Fault #4: Greatly Reduce the Payout to Heirs

What they say...

Leave a lasting legacy!

What they don't say...

The dismal participation rate of the ICM plus the expense of the GLWR coupled with the forfeiture of the step-up in basis may result in your heirs receiving far less than they should.

The Nitty Gritty and the Down and Dirty:

When taken in aggregate, the three previously addressed faults are likely to greatly reduce the funds retained by the contracts' beneficiaries. Assuming the GLWB outperforms the ICM, which is a fairly safe assumption, and the GLWB is properly exercised, the death benefit will be equal to the principal amount of the contract less the sum total of all distributions made by the GLWB. The death benefit is not based on the higher GLWB benefit base, but rather the lesser principal amount - and then that lesser figure is reduced by every dollar paid out by the GLWB.

In addition, the cost of the GLWB is subtracted from the principal amount each year the contract is in force. For example, if the annuitant lives 30 years after the issuance of the policy and the GLWB costs 1%, the principal will be reduced in excess of 30% over the life of the contract.

To add "insult to injury," any and all remaining gains will be taxed as ordinary income. Versus a traditional approach to indexing where the gains would likely be granted a step-up in basis upon inheritance and could avoid any taxation.

The Bottom Line

Athene's lineup of IAs, even more than other carriers, severely penalizes the beneficiaries of the contract. Since the principal may participate in as little as 10% of the index's growth, the payments made under the GLWB will assuredly exhaust the contract's principal in short order. Effectively, if you live too long, they stick it to you by paying you a lousy distribution rate. But if you die too soon, they stick it to your heirs by paying them not the higher benefit base but rather the lesser principal amount which will invariably grow at a fraction of the rate it should. Plus, all the payments made under the GLWB reduce the lesser principal amount dollar-for-dollar. It's a true "Heads you lose, Tails they win" outcome.

Request a Report to Learn how an IA will Impact your Legacy.

If leaving an inheritance is your utmost priority, an IA from Athene could wreck your legacy.

Fault #5: Everyone Else Gets Paid 1st

What they say...

An Index Annuity is a no-load, zero-fee product...

What they don't say...

The egregious expenses are embedded in the policy. The profits are derived from the variance between the poor performance of the ICM and the real-world performance of the investment strategy, which currently is in excess of 5%/year!

The Nitty Gritty and the Down and Dirty:

The agent is paid 7% of the premium as a commission. Then his boss and his boss's boss get another 2%. Tack on the 1% premium tax, and, right off the bat, 10% of your money is out the door before a penny is invested. How could the insurance company possibly provide such generous guarantees with only 90% of your money? Not to mention, what did these clowns ever do to earn 10% of your hard-earned retirement?

With the remaining 90% of your retirement, they still have to pay actuaries (expensive), underwriters (not cheap), lawyers (very expensive), service reps (not too expensive assuming English is the 3rd language), the executive suite (excessively expensive), and, let's not forget, the politicians (exorbitant). (GAMA, LIMRA and MDRT are the three most prominent political activism groups representing the industry.)

The real crime is simply that all these parties are paid years, perhaps decades before the policyholder gets paid. Invariably this leads to a "failure to perform".

The Bottom Line

Why would you pay a handyman his entire fee up-front? Maybe he finishes the job to your specifications, or maybe he drives off with half of your tools in the back of his pick-up. So why in the world would anyone pay up-front for someone to mishandle their retirement? The surrender charge, which will range from 7- 10 years, locks up the policyholder for a considerable period during which everyone gets paid except the policyholder.

Invariably, today's offering of annuity products will be abandoned by Athene in a year or two to make way for a newer, "better" version. Who is "driving the bus" on Version 2.0 once Version 3.0 is issued? Did you know that in the past 10 years, insurance industry stalwarts like AIG, The Hartford, John Hancock, and MetLife have all abandoned their entire annuity book of business? Now these policies are housed at no-name, spin-off institutions with virtually no motive to serve the policyholder beyond the minimum required by law. They all got paid and once the low-hanging fruit was picked, the annuity book was spun off to a separate entity.

Athene is a "johnny-come-lately" player to the world of annuities. The history is so brief, they don't even have a Wikipedia.org page. If big names like Metlife abandoned their annuity business, how likely is Athene to do the same when the balance sheet starts bleeding red? Perhaps the biggest risk with an annuity, one which is rarely given due consideration, is the "failure to perform risk". Across the four decades I've spent in this industry, I have yet to see an insurance company exert a fraction of the effort to service a policy as they did to sell it.

Click here for a No Obligation, Free IA Analysis

Learn exactly how Athene Annuities may fail in the real world.

Fault #6: Guarantees May Become Worthless

What they say...

Achieve your retirement dream. Your principal is fully protected, guaranteed not to lose money!

What they don't say...

The guarantee is based on the creditworthiness of Athene. Given that every policy is nearly identical, what kind of nightmare would it be if 100% of their policies lost money?

The Nitty Gritty and the Down and Dirty:

An IA, despite being issued by an insurance company, is not an insurance contract at all. Insurance companies make money in three ways: 1) Actuarial Gains, 2) The Float, and 3) Administrative Fees. With an IA, none of these revenue generators apply. There are no actuarial gains as every policyholder has the same outcome. The float is non-existent as all policy assets must be deployed in the index and hedging instruments. And I'm sure the sales rep was quick to point out that the contract has no administrative fees and expenses.

The cornerstone of the IA is the guarantee against loss. But what if that loss negatively impacts the creditworthiness of the issuing entity thus compromising the guarantee? What then is that guarantee really worth?

Here is where it gets really sticky. While the other "FAULTS" are predictable, this one is not. First, Athene is opaque. No one outside the company, including the agent who will bank 7% of your retirement funds, has any idea if they are properly hedging the index through the derivatives market. But if even they are, who is to say their derivative counterparties are financially sound? That is the big "what if".

The Bottom Line

If the stock market falls rapidly and severely, as it did in 1929, counterparties will fail and jeopardize the integrity of the derivatives market thus jeopardizing the IA guarantee. If the stock market experiences a deep, gradual decline, as it did in the 1970's, "at-the-money" puts will become prohibitively expensive thus Athene will no longer be able to afford protection to finance the guarantee. Will it happen, no one can say. But why buy a guarantee against a stock market decline from a company that very well may fail if the stock market declines?

Just an FYI, if an insurance company does go bust, which happens, the contract holder of a fixed index annuity becomes an unsecured creditor of the failed entity. Assets in an IA are commingled and not segregated for the benefit of the policyholder.

Click Here for a No Obligation, Free Annuity Analysis

Find out exactly what market conditions could lead to a catastrophic failure at Athene.

DIY Solution

Don't despair. The investment objective Athene is promising is fairly easy to accomplish in your own account. And when you do-it-yourself, there are all kinds of advantages. It's as simple as 1-2-3.

Disclosure: The following is not a recommendation to buy securities and is not sufficient information to formulate an investment decision. Derivatives, which include futures and options, carry substantial and unique risks. An investor must educate him or herself regarding all the unique risks of derivatives or work with an investment professional who is properly qualified to advise on derivatives.

- Buy the S&P 500 index either with futures or with individual stocks using an index builder at your broker. We do not recommend buying the index with a mutual fund as there is too much slippage and insufficient income. If you use futures, you will need to buy US Treasuries to replace the dividend yield of the index (This is what the insurance companies do as it generates more income but will have additional tax issues in a non-qualified account.)

- Take the taxable income from the dividends and/or US Treasuries and use it to buy at-the-money put options on the index. This will cover a good share of the insurance you'll need to protect yourself against a decline in the index but likely not all.

- To round out your need for protection, you'll need to sell out-of-the money call options on the index. Use the proceeds of these contracts to buy additional put options to achieve your desired level of protection.

In a taxable account. if the put options are profitable at year-end (i.e. the stock market declined in value), you will need to do tax-loss harvesting to offset the gains in the puts. The proceeds from the puts and the tax-loss harvesting will need to be invested in index funds or futures for 30 days to avoid having the losses voided with a wash sale.

Congratulations, you now are armed with the knowledge of how to build a customized portfolio with the same risk profile as an index-based annuity, but far better in almost every way:

- Tailor your investments according to your own values

- Retain total control of your own assets

- Remain fully liquid with no surrender charge

- Maintain flexibility to adapt to future conditions

- Gain perspective by being fully transparent

- Fine-tune your balance between growth and protection

- Reduce expenses thus boosting potential gains

- Reduce counterparty risk

- Reduce interest rate risk

- Reduce tax burden

- Reduce the anxiety of the unknown

- Eliminate "failure to perform" risk

Why invest in an opaque insurance contract with significant counterparty risk, an inability to adapt to the future, known performance issues, significant interest rate risk, and one that enriches everyone else except you? Again, let's follow Dave Ramsey's advice and "Stop making everyone else rich!"

If you have questions or would feel more comfortable with a little guidance in executing the Index Model, please reach out to us for help. We can be contacted via the Contact Us form on this website or by phone at either of the following locations: