Sequence of Return Risk:

A critical, yet little known, variable in determining how long your money will last in retirement

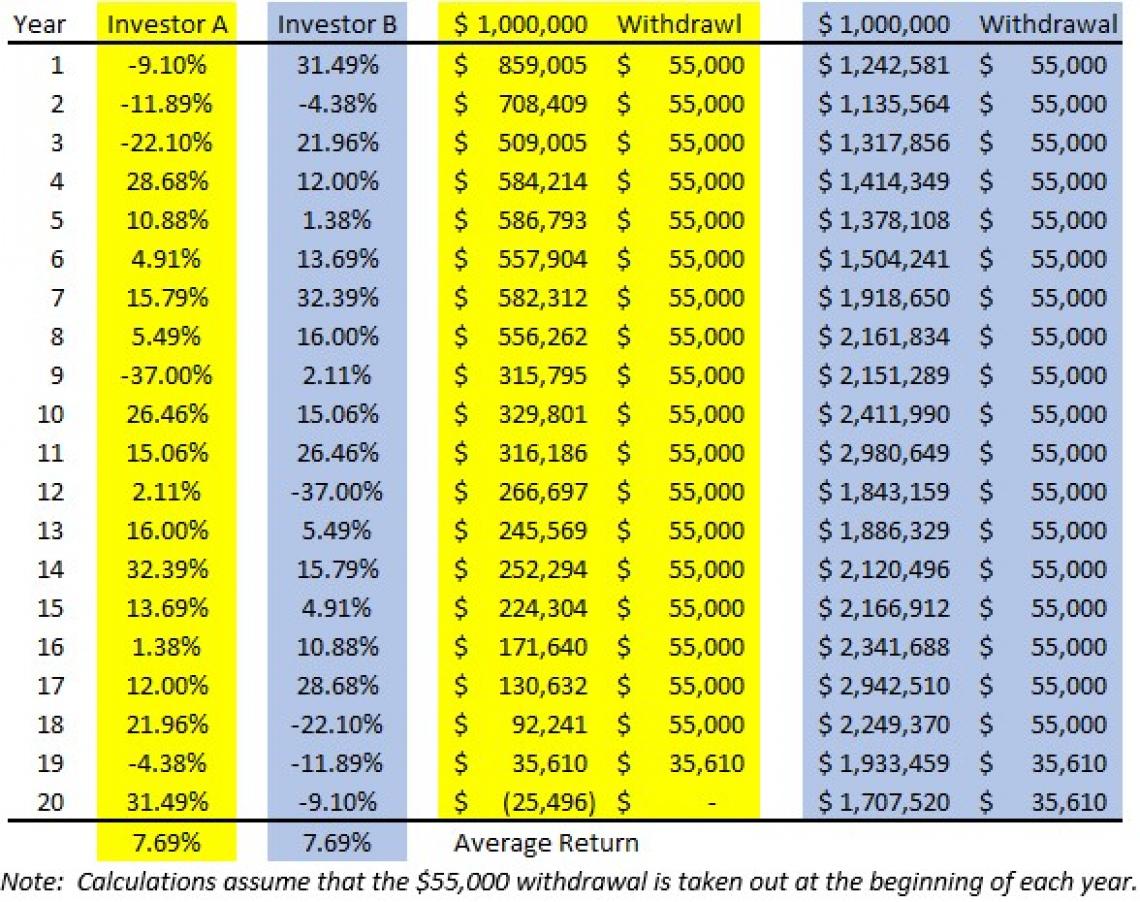

Riddle me this...two retirees with an identical nest egg, an identical investment rate of return and an identical distribution schedule. One is broke is 20 years while the other has nearly doubled her money. How is this possible? The answer is they have a different sequence of returns. While their average return is identical, one experiences losses in her portfolio just as she retires while the other experiences losses only after continuing to build her nest egg in early retirement.

The following chart outlines two seemingly identical situations, except for the sequence of annual returns.

The returns for this data are the actual returns for the S&P 500 from 2000 - 2019 (source: Slickcharts S&P 500 Returns). For Investor B, the returns were merely inverted so the first year's returns were 2019, then 2018 and so on.

What a remarkable contrast! Even as a 25-year market veteran who has studied market history extensively, I was shocked to see how this data played out. And I'm appalled at how rarely this information is properly conveyed to investment clients, if at all.

This startling discovery brings up two questions:

- Why is this information not ubiquitous in the financial services industry?

- What do I do with this information?

The answer to the first question is pretty straightforward. Wall Street loves volatility. Volatility creates trading activity and opportunity for Wall Street to game retail accounts. So it doesn't serve their best interest to educate the average retiree on just how dangerous volatility can be. The fact remains, if you absorb losses early in retirement, the odds that your assets will last your lifetime decline considerably.

Second, Wall Street needs passive investors to do their bidding. Pooled accounts like mutual funds are gamed to Wall Street’s advantage. This is where they park bad trades, trade with when volatility takes hold and they can't find a buyer or seller in the open market. And this is why 94% of all mutual funds underperform the market averages1. Because Wall Street is gaming them for their own gain.

So what to do with this information?

What makes this answer so difficult is that the prospects for any safe investment is so dire at this point. CDs at 0.5%? 10-year Treasury bonds at 1% with a negative real return? Where does one go? Where does one achieve a respectable return outside of equity markets?

Our investment solution is specifically designed to mitigate the Sequence of Return Risk. We start off with 2 major directives:

- Protect principle at all costs. It is Rule #1 for us. And it is based on the principle that it is easy to make up a 5% or 10% loss. But recovering from a 40%+ loss becomes nearly insurmountable given the Law of Parabolic Proportions.

- In every market, there is an opportunity for gains. Wall Street and the complicit media do a wonderful job of promoting FOMO (Fear of missing out). But we know that slow and steady wins the race. If we miss out on some gains today, we'll find new opportunities tomorrow.

If you feel that you are susceptible to Sequence of Return Risk, we would appreciate the opportunity to show you how we have mitigated this risk with real-world examples of risk management at its best. Simply fill out the form below and we'll contact you at our earliest availability.

1. Source: SPIVA