(Disclaimer - I am not a CPA, I do not provide tax advice, consult with your tax professional. The following is for informational purposes only and is insufficient for the purpose of making any sort of financial decision.)

As I understand it, Harrison Butker, the kicker for the KC Chiefs, made some unpopular comments about whether women should work outside the home or not. I didn't read his comments but I see the fallout has the internet all a buzz. For a moment, let's just step back from the politics and morality of the issue and just consider the math. Here is how the US government "DIPs" further into your wallet if you live in a two-income household (and why I believe Congress just magically flipped on the issue of gay marriage).

The DIP - Dual Income Penalty

The problem with dual incomes is the onerous taxes that get slapped on the second spouse. If one spouse earns a solid wage, he or she kicks their spouse into a much higher income tax bracket. But the real problem is FICA taxes. FICA is not based on household income but rather each individual's income. So the second spouse has a much higher effective income tax rate plus they must pay FICA on 100% of their income up to $168,800.

FICA stands for the Federal Insurance Contributions Act which includes taxes to cover Social Security and Medicare. 7.65% of an employee's salary goes to this tax up to a limit of $168,800/year. Further, the employer matches this amount also paying 7.65% of the employee's salary into FICA. I, as a self-employed individual, have to pay the entire 15.3% myself.

For this discussion, I am going to assign the FICA tax rate at 15.3%. Some would point out that is unreasonable as the employee's share of FICA is only half of that. To that, I say "Balderdash". If your employer didn't have to pay the other 7.65% of FICA, they could afford to pay you an additional 7.65% of your salary. So indeed, all employees have a FICA burden of 15.3% up to $168,800 in 2024.

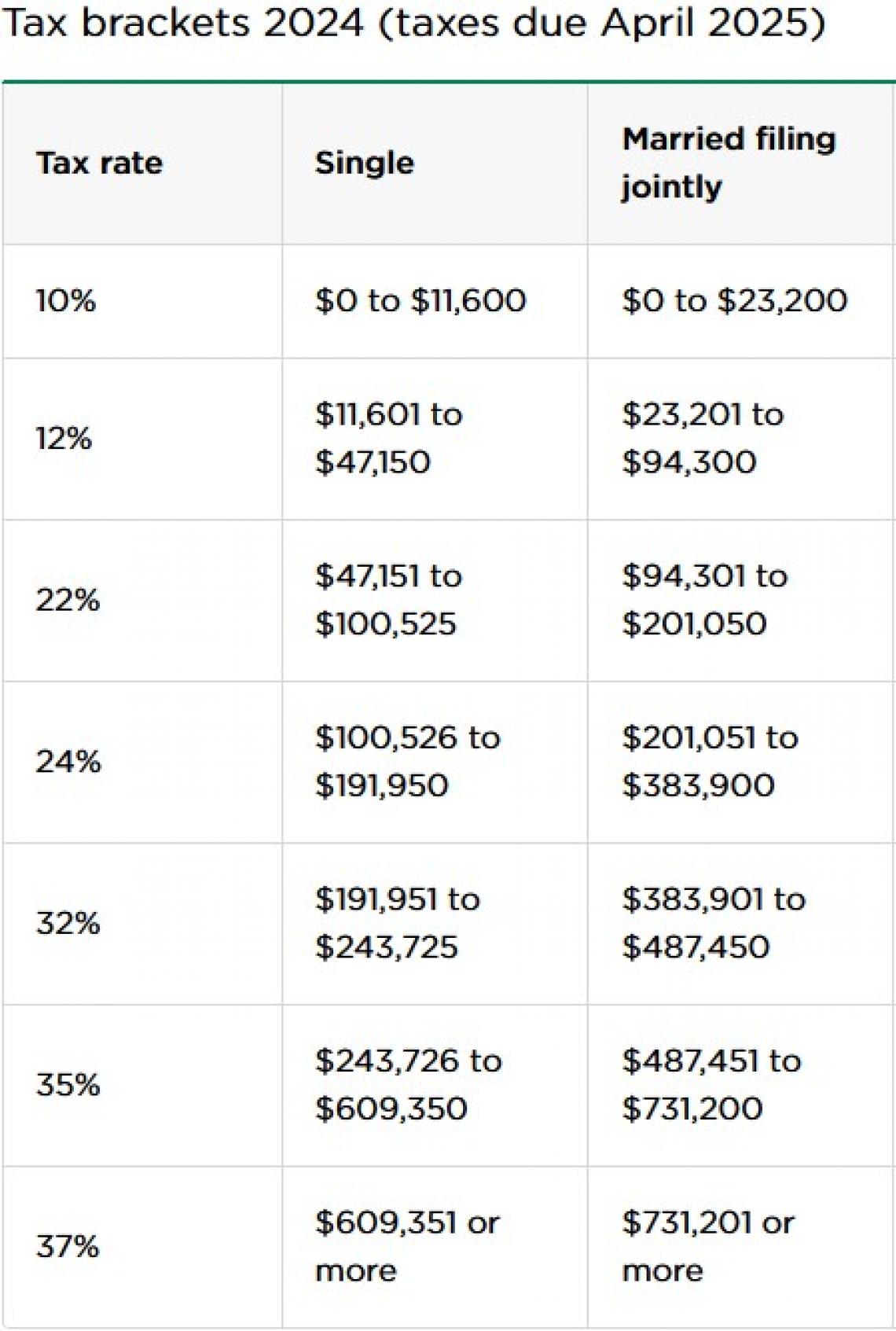

Here are the income tax brackets and corresponding rates for singles and those persons married and filing jointly, courtesy of Nerd Wallet.

Let's consider some examples. First, a straightforward example where one spouse works outside the home and makes $200,000 per year. Income tax on this amount would be $31,106 which equates to an effective income tax rate of 17.05%. Further, the FICA tax would be $25,796, bringing the total tax burden up to $59,901.80, an effective tax burden of 29.95%.

For the sake of full disclosure, these calculations are simplified not taking into consideration AGI or deductions. The sole purpose of this article is to illustrate the additional tax burden, or DIP, heaped on dual-income families, not to provide specific tax advice.

Now let's consider the situation of a dual-income household. We'll keep Spouse A at the same income level making $200,000/year while Spouse B contributes another $100,000/year. Spouse A will have the same tax burden as from above but Spouse B's effective tax rate will be higher.

The New Year's Resolution won't even be broken by the time Spouse B is kicked into the 24% tax bracket which starts at $201,050. $1050 of income will be taxed at 22% and then the rest of his or her earnings will be taxed at 24%. Thus, the effective tax rate will be just a hair under 24%, 23.98% to be exact, compared to Spouse A's whose effective income tax rate was just 17.05%, a difference of just under 7% or right about $7,000 of additional taxes due for the year.

All of Spouse B's income will be subject to FICA at 15.3%, which equates to $15,300. Spouse B will have a total tax burden of $$39,279 or 39.28% of income compared to Spouse A who only paid 29.95% of his or her income. Thus, Spouse B is practically working 40% of the year just to pay taxes.

Let's consider a more extreme example. Say Spouse A earns a cool half million each year. The effective income tax on this amount would be $115,749.50 or 23.15% and FICA would come in at $25,795.80 or 5.16%. The total tax burden in this scenario actually drops to 28.3% because he or she is so far over the FICA threshold.

Assuming Spouse B earns $150,000, every dollar earned would fall into the 35% tax bracket equating to $52,500 paid in income taxes. 100% of the $150,000 is still subject to FICA which equates to $22,950 in taxes. The total burden would be $74,450 or just over 50% of Spouse B's income goes to taxes. Perhaps Spouse B appreciates the Federal Government more than I do, but I certainly wouldn't work right up until the July 4th holiday just to pay taxes.

Of course, If we go deeper by taking other factors into consideration such as worker's comp, standard deductions, ect, then the DIP becomes even more egregious.

Obviously, there are other considerations beyond just taxes, both financial and personal.

When my wife worked outside of the house, she would wear pantsuits. I only know two things about pantsuits. One, they are not free, and, two, she has never worn one outside of the workplace. If she were still employed outside of the house, I am sure we would invest a small fortune in the unfortunate work attire known as women's pantsuits.

Then there is the cost of transportation. My wife schleps our kids around in a 16-year old Cadillac DTS that we bought for pennies on the dollar. I fully expect we could sell it today for what we paid for it even though we have owned it for three years and put well over 30k miles on it. Thus we have avoided the largest expense of owning a car, depreciation. And we paid cash for the car so no interest expense. (Before you start feeling sorry for my wife and our kids, her 16-year old Cadillac DTS is a 6-pack stretch limo that the kids and their friends find hilariously awesome while mom can raise the divider when the kids get unruly. ) Her primary mode of transportation cost a fraction of her working friends' shiny-new SUV's and hasn't depreciated. And of course, she puts fewer miles on her car saving gas and maintenance costs. Does it occasionally break down? Absolutely. And when it does, dad runs carpool for a couple days. No big whip.

And then there is how we eat. My kids and I are fed six home-cooked meals for dinner each week. And often, I get to take leftovers for lunch. And I'm not talking about throwing a frozen lasagna in the oven, I'm talking from-scratch, home-cooked meals. Not only does it taste far better and it's far healthier than eating out, it's far cheaper. My wife keeps track and often she'll tell me, "This meal costs just $2.07 per plate".

In the end, because of her chosen profession as a homemaker, we spend less on clothes, less on cars, less on food, and a heckuva lot less on taxes! I assume if my wife worked outside the house, we may have a little extra coin laying around but the amount we have left over would be a pittance compared to her salary.

There certainly are other factors to consider. Years ago, I worked at my aunt's temp-staffing agency and there was a parade of women we employed who received a fraction of what they were worth because they had been out of the workforce while raising kids. (I specifically remember a woman who graduated from the J school at Mizzou and we sent her out on a $12.50/hour job just to get back into the workforce!). On the other side of that coin, I know men who have persuaded their spouses "to go back to work" before divorcing them so they wouldn't have to pay as much alimony. (In Texas, if a person has not worked in 10 years, the divorce court deems that person to be unable to earn a livable wage and the working spouse must pay a much higher amount of alimony.)

Ultimately, I don't care, nor is it my place, to speak to the morality of one spouse staying at home or not. It certainly has worked out for our family but I know some families can't afford it. And for some families, the intangible benefits of two incomes outweigh the additional expense and taxes. But make no mistake about it, if one spouse has a significant income, due to the DIP, the other is spending more than his or her fair share of time and effort just to pay more in taxes.