BAD NEWS FOR RETIREES!...especially those living on a fixed income.

Fed Chairman Jerome Powell made a highly anticipated announcement this morning the FED will make a significant shift in their approach to keeping a lid on inflation. In practice, instead of trying to cap inflation at any given time at 2%, they will allow the inflation rate, as they measure it using the CPI, to run hotter than 2% for a spell of time. According to the FED, inflation has been under their target for quite some time so allowing it to exceed their target is not only acceptable but advisable. I contend that any level of meaningful inflation is an adjunct failure on part of the FED.

For those of us living in Main Street America, we know that a) targeting any level of inflation is a bad idea and b) their measure of inflation consistently marginalizes the real impact of inflation, especially for retirees who have to allocate a disproportionate amount of their income towards daily necessities. Many years ago, I wrote the CPI Lie which you can read by clicking on this link.

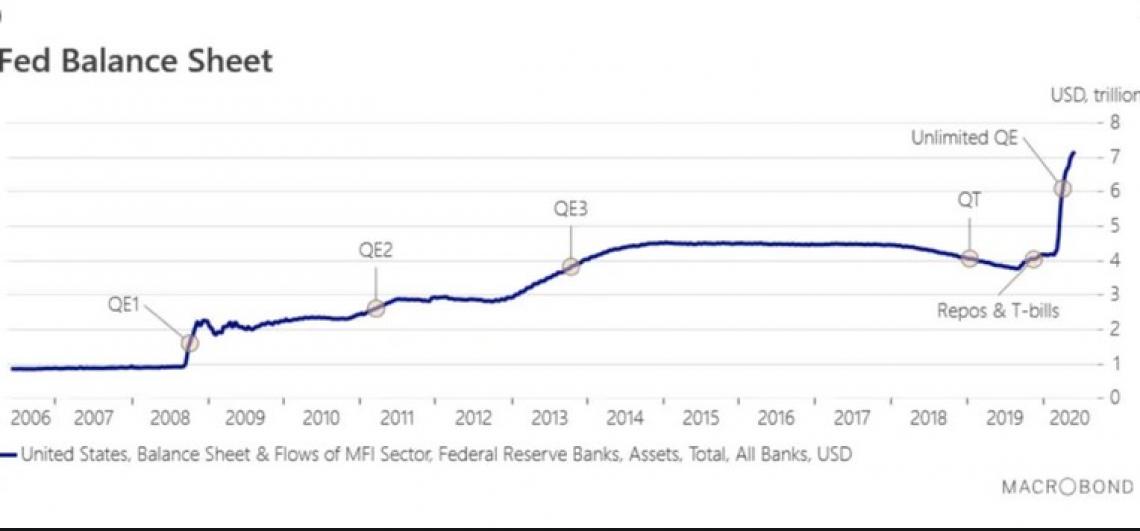

The old saying goes, the only thing definite in life is death and taxes. Well, what the FED thrust upon us today is a huge inflation tax. Since the FED's creation, they have devalued the currency over 99% through rampant inflation when measured relative to gold. When the FED was created in 1914, gold was fixed at a 20:1 ratio to the USD. Today gold is north of $2000/oz. In response to the Covid, the FED literally blew up their balance sheet and as a result, the stock market has rallied in a fashion unseen in its history. Here is a chart of the FED balance sheet over the past couple of decades. And this figure doesn't include the money they print that is injected into their banks.