Goldman Sachs, possibly the de facto leader of Wall Street, is calling for much lower average returns for the S&P 500 over the next 10 years. Here is excerpt from Yahoo!Finance:

Goldman Sachs forecasts that over the next decade the S&P 500 will yield an annualized return of 3%, significantly lower than 13% yearly return over the past ten years. David Kostin, Goldman's Chief U.S. Equity Strategist, offered this view in a note on Thursday, which is noticeably below the general market consensus of 6%.

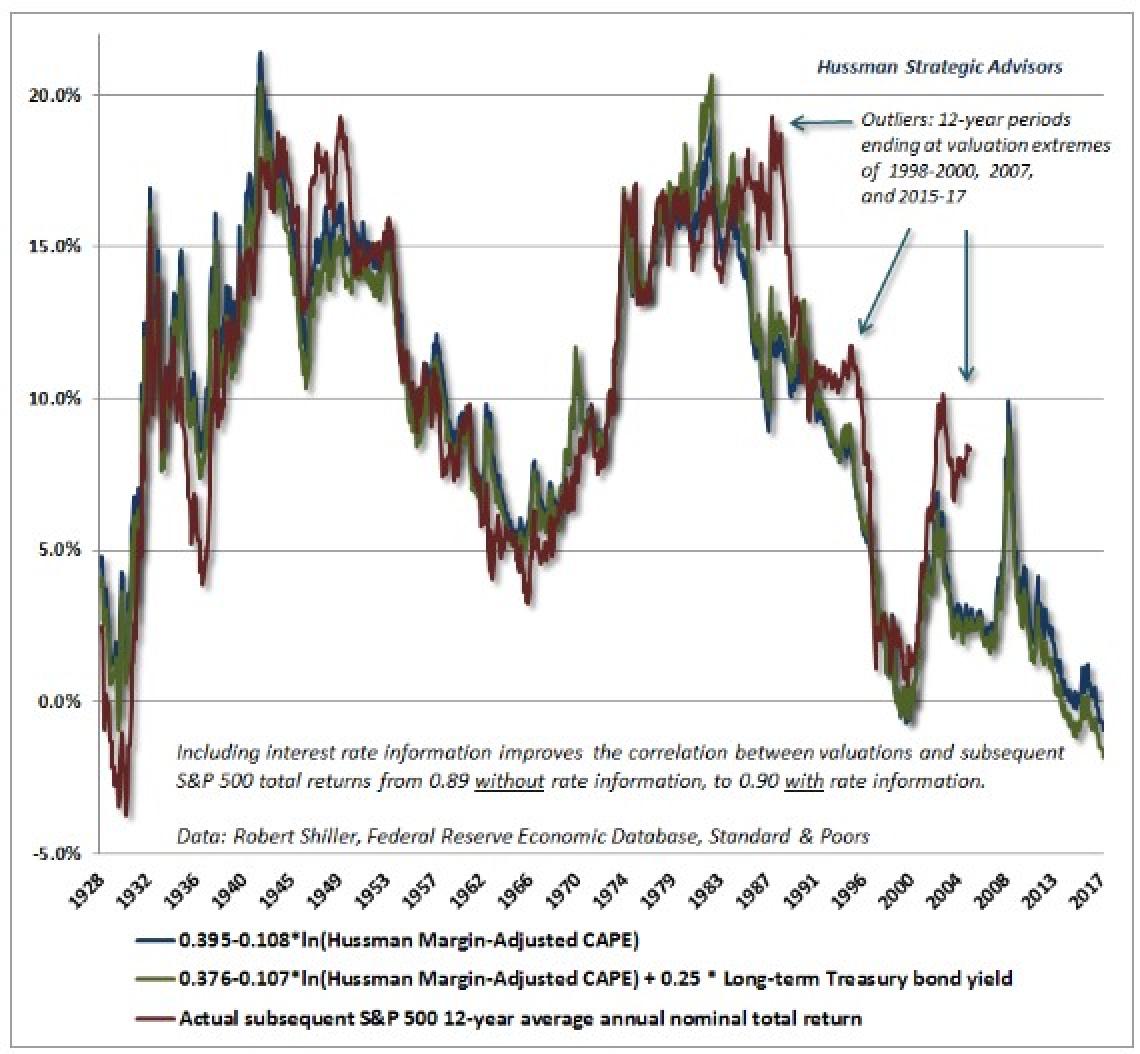

The article says very little as to how Goldman arrived at such a conclusion. One could defer that it's primarily due to the current sky-high valuations for the S&P 500. Historically, there is a strong correlation between current stock market valuations and future returns. Dr. John Hussman has done several in-depth studies on this phenomenon which you can read about by visiting his website by clicking here. Here is a chart he created which illustrates the clear-cut correlation between current valuations and future returns.

The question I think that must be asked is quite simply, if the 10-Year US Treasury is yielding over 4%, a 1% advantage versus the expected returns of the stock market, why should an investor accept the volatility and inherent risks of equities? Why not just shift one's entire portfolio into conservative bonds?