For some time, I have warned about the geopolitical risks coming out of Russia, and, unfortunately, my warnings had considerable merit. Here are a couple of posts I have written on the subject:

Russia takes big steps in fighting USD hegemony

It was fairly obvious that Russia would be disruptive in the geopolitical sphere. Their economy has been a wreck for some time. Covid accelerated their economic descent. They have been growing increasingly agitated and restless with Western powers dictating global dynamics. Unfortunately, Russia decided to be disruptive in an entirely tragic way by invading Ukraine.

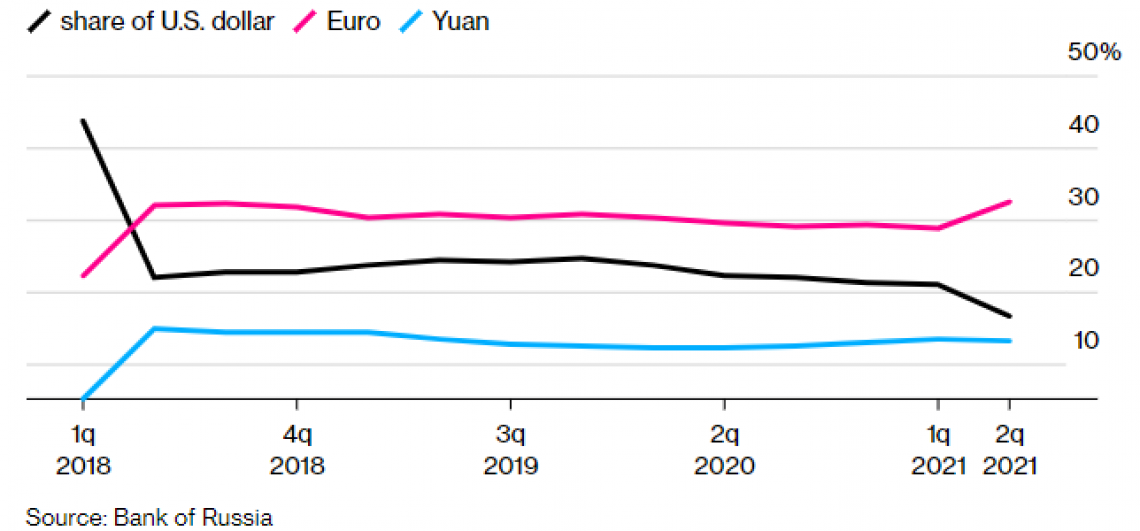

Russia started liquidating its USD reserve holdings in 2018. This was the "canary in the coal mine". Never would or could Russia fight the ideological advancement of Western values in the former Soviet Union if it was still beholden to the US Federal Reserve. As it is, the US has used its economic powers to further degrade the Russian economy. But since Russia does relatively little trade directly with the US and since they have liquidated their USD holdings, they have more leeway in defying the wishes of the US and our central bank. Here is a chart of their holdings since 2018 through last summer when they announced they would liquidate their holdings of USD-denominated assets entirely.

As the old saying goes, "just follow the money." And by following the money, one could easily predict Russia was setting itself up to no longer play nice with the US. Clearly, Russia has been positioning itself for some time to launch a physical attack on Ukraine and consequently an economic attack on the West. Russia knew full well that its "liberation" of Ukraine would not take place in a vacuum. And now we see what happens when a major world power no longer cares about playing nice with the US.

While I have often warned about disruptions from Russia, I have also voiced my concerns about Saudi Arabia. Both counties are run by megalomaniacs whose sense of reasoning has nothing to do with logic or convention. And as the old saying goes, "just follow the money."

The Guardian just reported that Saudi Arabia is allocating a preposterous amount of capital to Jared Kushner's new private equity fund, Affinity Capital. The article explains how Trump's son-in-law is hardly even a neophyte in the world of private equity investing; thus, it essentially concludes that no prudent person or entity would invest such a large sum with such an unproven entity. The article concludes the allocation to the Kushner-run fund is merely a thinly-veiled attempt to gain the favor of ex-President Trump.

The article goes on to say how the Crown Prince of Saudi Arabia has refused to take calls from current President Biden. And how they have been wholly uncooperative in managing oil supplies in light of the events in Eastern Europe. It goes on to list several pieces of evidence that Trump and bin Salman have become quite cozy whereas Saudi Arabia's relationship with the Biden administration has grown increasingly cold.

What does this all mean? I am not sure. I just know that Saudi Arabia has played nice with every Presidential administration, regardless of party affiliation, since the establishment of the Petrodollar in the early 1970's. For them to now take sides and throw their support towards a defeated incumbent over the residing President is disturbing to me. Given that Saudi Arabia serves as the Petrodollar police, I believe this is a developing risk that needs to be carefully watched.