He who loves money will not be satisfied with money...

- Ecclesiastes 5:10 -

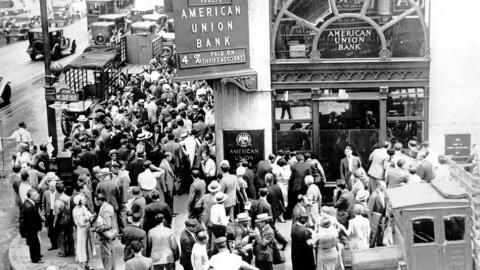

For nearly 70 years, the US economy ran relatively smoothly without a significant hitch from the banking sector. Aside from a few S&L's that got sideways in the 80's, the US banking sector was the model of efficiency from the mid-1930's until 1999. The reason -- A simple act of legislation known as The Glass-Steagall Act.

In late 1999, a bill by the name of the Gramm-Leach-Bliley act, sponsored by Senator Phil Gramm of Texas along with a couple other of horribly wrong-minded bureaucrats, overturned The Glass-Steagall Act. The bill was also called the "Banking Modernization Act" (what a tragic misnomer.) Shortly thereafter, the stock market began its first in a series of plunges that would wipe out huge chunks of wealth for everyday Americans. It is quite clear that no other piece of legislation in the past 30 years has had such a destructive impact on our economy as the overturning of Glass-Steagall.

What did Glass-Steagall do:

The act accomplished several things but most importantly, it prohibited a bank holding company from engaging in other types of financial services. Therefore, an institution had to decide to be either a traditional bank (create loans), an investment bank (create and broker securities) or an insurance company (create insurance policies).

Why was this so effective in regulating banks:

Glass-Steagall was so effective because it forced the banks to police themselves. Without this regulation in place, the banking industry became a free-for-all where any banker could do anything.

Take in the quote from above again. He who loves money will not be satisfied with money.

When someone loves something, the only thing more important than having the thing you love is making sure someone else doesn't have more of it.

Bankers love money. Why else do you get into banking? They don't save lives like doctors, they don't promote justice like lawyers, they don't shape young people like teachers, they don't make goods like manufacturers, they don't create new technologies like inventors...they just make money. The problem is no matter how much money you make, it will never be enough. They will never be satisfied.

The one thing more important to bankers than making money is making sure some other banker doesn't make even more money. If Banker A is doing X and making a killing while Banker B is prohibited from X, you better believe that Banker B is going to do everything he can to stop Banker A. Once Glass-Steagel was repealed, there was nothing stopping Banker B from doing X so there was no reason for him to stop Banker A from doing it either. In fact, Banker B was incentivized not to stop Banker A because the party would be over for all of them. There was absolutely no incentive for the banks to police themselves and given their level of sophistication, the government was and still is unable to do it.

Would Glass-Steagall prevented the Financial Crisis 2008:

ABSOLUTELY. Let's assume Goldman, Merrill and the other investment banks were not permitted to execute loans which is a traditional banking activity. And let's assume that JP Morgan and BofA and Citi were not permitted to securitize loans which is an investment banking activity. And let's assume AIG, an insurance company, had to stick to writing insurance policies that were backed by real collateral.

So, Citi starts writing all of these NINJA loans. No income, no problem. No down payment, no problem. Well, there would be a problem because Citi would have to do one of two things with these loans. Keep them on their books or sell them to an investment bank to securitize them.

So, Citi is wildly profitable writing a bunch of no-doc mortgages to people who have no earthly means of ever paying them off. Would Goldman buy these loans? Hell no. They would have done their due diligence and found that these loans would go bust. Without anyone to buy the loans, Citi would have had to keep them on its books. And with that, you can be certain that Goldman's bond department would surely tip off their equity analyst that Citi was chalked full of crappy loans and advise them to sell their stock. And which point in time, Goldman would issue a "buy" on Citigroup, dump all their Citigroup shares and then turn around and put a "sell" on them. (Oil call for $200!!!!).

But by 2005, Goldman was in on the mortgage business. And so were Merrill, Morgan, Bear and Lehman. And AIG was writing all of these faux-insurance contracts on the entire mess that were backed by nothing. A fart in the wind was more tangible than the collateral on all the CMO's. How could Goldman question the loans Citi were writing, they were writing the exact same loans. If the equity guy at Goldman put a sell on Citi, everyone would surely ask, "Don't you have the exact same exposure on your books?"

What must be done:

Bureaucrats cannot effectively regulate the banking business. Wall Street has a rare combination of extreme intelligence coupled with a complete void of morality which aids them in creating all sorts of schemes to separate the investor from his money. Regulators just can't keep up. The only way to have effective banking is for the banks to police themselves. And the only way to do that is to make sure they are not all in the same boat. Once this takes place, then our economy will be on the road to recovery. That's what it took in the 1930's (Glass Steagall was passed in 1933 just when the stock market bottomed) and that's what it will take in the 2010's.

Until the out government reinstates Glass Steagall, I would ask all my fellow Americans to end all business dealings with any bank or brokerage outfit that isn't in compliance with the Act. By compliance, I mean they must not engage in both traditional lending and other forms of financial services. So your bank should never be your broker (or anyone's broker) and your broker should not be your bank (or anyone's bank).