Its summertime and while scores of families on break will be going to the beach over the next month, I've made the unilateral decision to take my investment portfolio "to the beach". I liquidated nearly all our positions with significant beta this past week. (Beta is the term used for stocks, or any securities for that matter, that have a high correlation with the S&P 500.) We are still holding some hard assets for which my proprietary MAP system is suggesting have more room to appreciate. But otherwise, we are positioned very defensively right now with a large allocation to short-term US Treasuries and Treasury Inflation Protected Securities (TIPs) along side the aforementioned hard asset exposure.

My decision was not made flipantly. I have conducted an incredible amount of research and have determined that at this time the odds of the stock market going down are higher than it going up. All my research could be wrong and the stock market could continue higher but I don't believe its prudent to chase the stock market in its current state. I had a bit of an epiphany this week as I was making myself a peanut butter & banana sandwich. The peanut butter jar was nearly empty. Of course, the peanut butter jar is never completely empty. But at some point, getting the remaining peanut butter out of the jar is far more effort than and time than its worth. As I sat there scraping the bottom for the last micro ounces of peanut butter I thought to myself, is this really worth it? Then I sat down at my desk and saw how we are sitting on considerable gains for the year and thought, "Was risking a big downside surprise worth the time and effort just to squeeze a few more 'bps' out of an incredibly overvalued, strenuously overextended stock market?" My conclusion was a resounding "NO".

My decision was derived from three seperate factors. First was the fundamental outlook of the market. Second was the current technical picture of the marekt. And the third and final factor is our current YTD gains which have far outpaced just about any benchmark one might use. I'll now cover each of these in some detail.

This update will be long, but that is because of how critical it is. I've determined that any meaningful exposure to the stock market moving forware is simply not prudent until conditions change. I'll continue to monitor those conditions but taking a snap of shot of where the stock market stands today, its clearly a fool's errand.

1. Fundamental Outlook

Last October, a Goldman Sachs analyst released an incredibly alarming report. He stated that the S&P 500 was likely to deliver returns in the 3%/annualized range over the next 10 years. That is far below the 13% the stock market had delivered over the past decade and a half since the Financial Crisis. In the inteirm, the S&P 500 has delivered a 7% return, over twice what Goldman said it would do on averager over the next 10 years. If this report is proven to be valid, then the return for the S&P 500 over the next nine years and three months should be in the 2.25% range. Which raises an incredibly simple question. If a 10-year, "risk-free", US Treasury is yielding 4.4%, why in the "wide, wide world of sports" would anyone assume stock market risk for a 2.25% when he or she could just invest in US Treasuries and "go to the beach" for the next nine years?

The basis for the Goldman Sachs report is largely based on Dow Theory which states there is an inverse relationship between the current valuation of stocks and their future returns. The higher the valuation, the lower the return. And currenlty, stock market valuations are obscenely high.

I relate to this idea by using the concept of a rental house. Say, you own a rental house that generates $1000/month in rent and expenses for the house are $2000/year which means you net $10,000/year in income. If you bought the house for $100,000 then your return is 10%. But if you paid $200,000 for the house, then your return drops to 5%. Dow Theory uses the same math when projecting future returns for the stock market. That the sum total of profits generated by all 500 companies in the index should generate X profits. X is the numerator in the fraction where as the valuation of the S&P 500 is the denominator. Valuation can be measured in many ways but the most common and most straight forward way to measure it is simply using the Price/Earnings ratio, or P/E ratio. You can visit any financial site and it will site the "P/E ratio" for a given stock or index. At this point in time, the valuation or P/E ratio of the S&P 500 is easily two times higher, probably close to two and half times higher, than the historical average. Thus, if an investor is paying twice the historical average for an asset, whether it be a rental hosue or a stock market index, then he should expect half the historical future return.

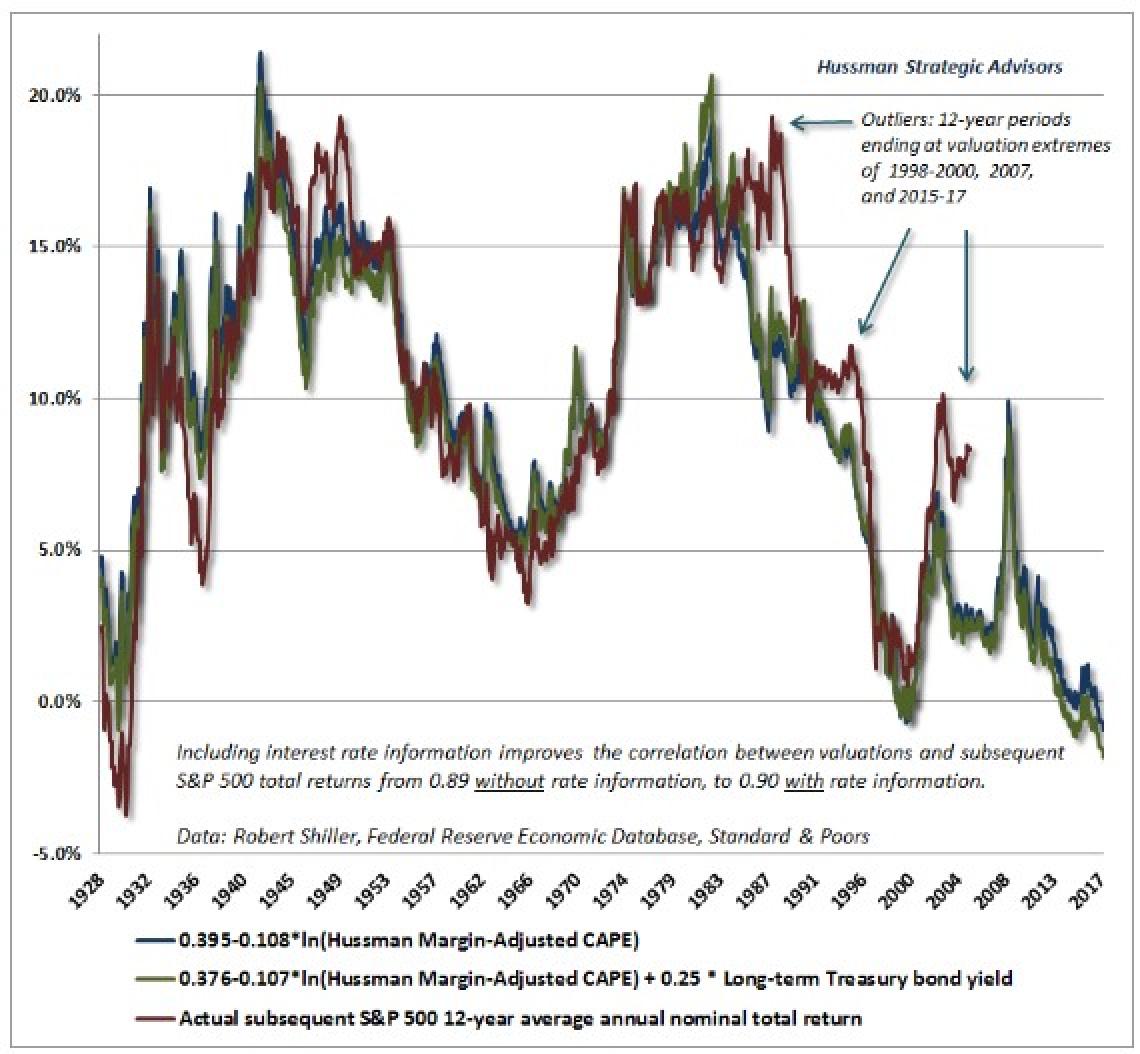

There is a brilliant analyst named Dr. John Hussman who has taken this research and drilled down further than most any others. His outlook is far more dire than Goldman Sachs and his valuation metric is far more complex. He calls his metric the "Hussman Margin-Adjusted CAPE ratio" but it approximates the P/E ratio.

Hussman's model is far more pessimistic calling for negative returns over the next 12 years. Below is a chart of his model while illustrates how remarkably accurate it has done in predicting future returns over the past 100 years. If you can to do a much deeper dive, then you can visit his site by clicking here.

2. Current Technical Picture

One might ask, if Goldman came out with their report in October and Dr. Hussman's model has been supremely bearish for quite some time, why now am I just "going to the beach"? Why have I been as aggressive as I've been so far this year? Of course, I would argue that even when I'm aggressive, due to my risk management techniques, my approach is still far more conservative than most others which was clearly on display in March and Early April of this year. But I have had considerable stock market exposure the past couple of months and the question is "why now"?

And the anwser is the current technical picture for the stock market...which is really, really ugly. I would argue the technical picture is as ugly as I've ever seen as stock markets are hitting all-time highs.