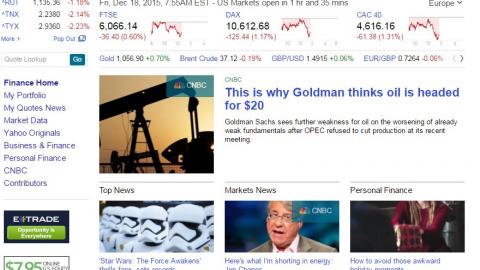

On January 13th of this year, I wrote a post called Great Day to Buy Oil? It wasn't the lowest close in oil in Q1 but darn close to it. And it turned out to be a great day to "trade" oil on the long side as it shot up over 31% in the next five months. I based this call on a single, simple contrarian indicator; which was, a bearish oil call in the media by Goldman Sachs. Well, today, that contrarian indicator is signaling a buy again as the headline on Yahoo!Finance is "This is Why Goldman Thinks Oil is Going to $20!".

Goldman is legendary when it comes to talking up their book. If they are looking to add positions, all they need to do is put out some BS story to the complicit media and voila, oil prices see weakness again. But the weakness will be short lived. Why anyone believes this den of liars anymore is beyond me (both GS and the media! And I don't want to exclusively pick on Yahoo, the article was written by CNBC and appears on the front page of their website. I am sure a simliar article will show up on Bloomberg at some point but it hurts my head to visit too many of these sites in one day so I will refrain from checking.)

As I wrote in a post earlier this week, oil is trading with an unprecedented level of contango meaning the market is absolutely convinced prices are going up next year. But buying oil in the paper market will be tricky b/c of the contango premium. ETFs such as USO will get destroyed while the contrango is wringed out of the market. And spot prices must go up at least 24% to hit Dec '16 contract prices in order for a long position in this contract to break even.