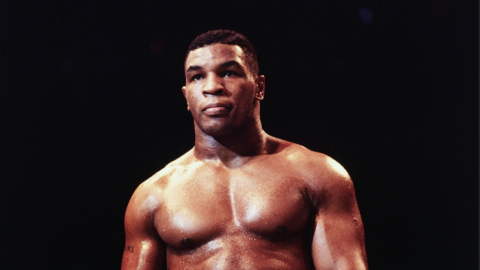

- Everyone has a plan until they get punched in the mouth -

Mike Tyson

Capital markets are doing their best "Iron Mike" impersonation by punching equities right in the mouth. The S&P 500 has now joined the NASDAQ and long-term US Treasuries in bear market territory. This month we have seen some real carnage in the markets with retail names like WMT and TGT getting thrashed. This bear market has been particularly tough on many investors as they were told by their advisors that they "had a plan". But unfortunately for most investors, that plan was in the form of a "60/40 Balanced Portfolio" and it's just not holding up.

We are fortunate to be sitting in the black on a YTD basis. This is now my fourth bear market and I successfully navigated the prior three. I have been blessed with various tools which have helped me and my clients avoid the worst that prior bear markets have had to offer. My plan has worked in the past and by all measures is working now.

I have a strong bear market bias as I came into the financial services business at the head of the dot.bomb bear market. I know a lot of people who lost a good part of their life savings in '01 and '02. Upon seeing the devasting impact a bear market can have, I entered the financial services business determined to find a better way to invest clients' money. I have experienced a lot of bumps in the road in the 20+ years since but I have continuously iterated on my approach, I have been provided with some very effective tools and I'm confident I'll continue to protect my clients' assets if the stock and bond markets continue to decline.

With that said, bear markets are unwieldy beasts. There is a massive amount of leverage in the markets and when that leverage starts to unwind, it can do so in a wildly erratic manner. The last time markets experienced widespread deleveraging was in the second half of 2008. While fundamentally bankrupt investments went bust. the market took down fundamentally solid investments as well. Everything fell all at the same time and desperate, overly leveraged investors had to liquidate "anything with a bid". Just a couple weeks ago, I wrote a post called "Deleveraging, Deflation, or Devaluation" which explained how I have been seeing overt signs of deleveraging which has me terribly concerned. And today is options expiration and with equity markets declining eight weeks in a row for the first time since 1932, there will be sizeable losses among those who wrote put options and other contractual bets against the stock market. The question becomes, will these investors be hit with margin calls next week and what could the fallout be.

The title of this post includes the phrase "Right on Time" which is precisely the case. Last May, I wrote a post, "7-year Cycle on the Horizon" which explains that for the past 100+ years, every bear market has taken place subject to a 7-year cycle. Never has a bear market, until 2020, occurred outside the 7-year cycle which we are currently in now. If you haven't read the post, I encourage you to. The data is nothing short of remarkable. And if you are losing sleep over your investment portfolio, then I encourage you to call us. I have a plan and the plan is working. Below are our local numbers.

North Texas: 214-954-4300

Central Texas: 512-553-5151