He who loves money will not be satisfied with money...

- Ecclesiastes 5:10 -

(For full disclosure, our long/short strategy is currently short USB and LNC. We may increase or decrease these positions or positions correlated to these two securities at any time without notice.)

Like so many others, I would like to weigh in on the collapse of SVB and the subsequent bankruptcy of two additional regional banks. Unlike so many others, I will get directly to the point. The problem is not rising interest rates, deposits over the FDIC limit, a mismatch in durations between their loans and deposits, lack of compliance, failure of regulators, a “hail mary” equity offering, or anything else one might read in the financial media. The cause is simply the Graham-Leach-Bliley act (GLB). And the solution is simply the reinstatement of the Glass-Steagall Acts (GSA), which GLB overturned. All of these other variables which the media espouses are simply symptoms of the disease which is a failed regulatory framework for our financial industry.

If GSA were still in place, investment banks like GS or MS would have blown the whistle on lending institutions like SVB long before they collapsed. And knowing this, SVB would have behaved themselves. But since GS and MS have moved into the lending business alongside of SVB, blowing the whistle on them would mean blowing the whistle on themselves. Thus, with no one to call out SVB’s malfeasance, SVB had no incentive to behave themselves. Essentially, with GLB, the foxes are watching the hen house.

Charles Schwab, who has seen its stock undergo nauseating swings in sympathy with the regional bank index, may be the starkest example of how GLB fails. Under GSA, Schwab would have issued a sell on SIVB before Powell’s second rate hike. But instead, they are in the same boat as SVB and thus refused to admit they too were taking on water.

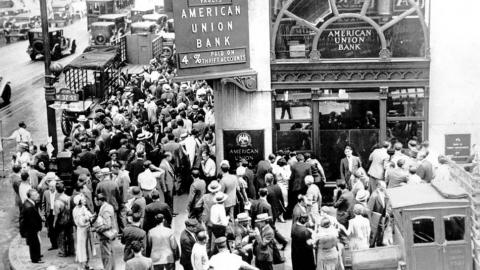

But SVB is yesterday’s news. What about the future? The two questions on everyone’s mind is: “Will there be contagion?” and “Will it happen again?” I can’t answer the first question. Putting a “ring-fence” around these institutions, as they should have done in 2008, was likely necessary and should stave off a widespread run on the banks. However, the cute, little new lending facility the FED created on Sunday, which allows banks to collateralize underwater bonds at 100c on the $1, is horribly misguided. This facility is just one more back-door bailout and will invariably result in a moral hazard. It may help prevent imminent collapse, but it may also steepen the eventual decline in the banking sector.

Now to the latter question. “Yes, it will happen again.” Without question. Because without GSA, banking crises always happen. Here is a rundown of banking crises in the US over the past 200+ years:

Pre-Glass-Steagall

1792, 1796, 1819, 1825, 1837, 1857, 1869, 1873, 1884, 1893, 1896, 1901, 1907, 1910, 1914, 1917 and then the grandest of them all, 1929 – 1932.

Post-Glass Steagall

2001, 2008 and now 2023.

There was not a single example of a banking crisis that bled into contagion between 1934, when Glass-Steagall was passed, until 1999, when GBA overturned it.

Yes, I am aware all my peers from Texas will point to the S&L Crisis but technically it did not meet the contagion criteria. But even if I give you the S&L Crisis, that is one modest crisis over a 64-year span. Today, we are experiencing the third banking crisis in just 24 years. Even the accountants from SVB could discern that 1 in 8 is far greater than 1 in 64 (The ratio is 1:8+ prior to GSA as well – 17 over 140 years). Further, 2008 was several degrees of magnitude greater than the S&L Crisis. So, its indisputable that the Glass-Steagall Acts are the only remedy to the perennial banking crisis problem. Until its reinstated, which unfortunately will not take place any time soon, history has dictated that a banking crisis will take place every eight or so years.